Home » What We Do

Helping you hit your financial target

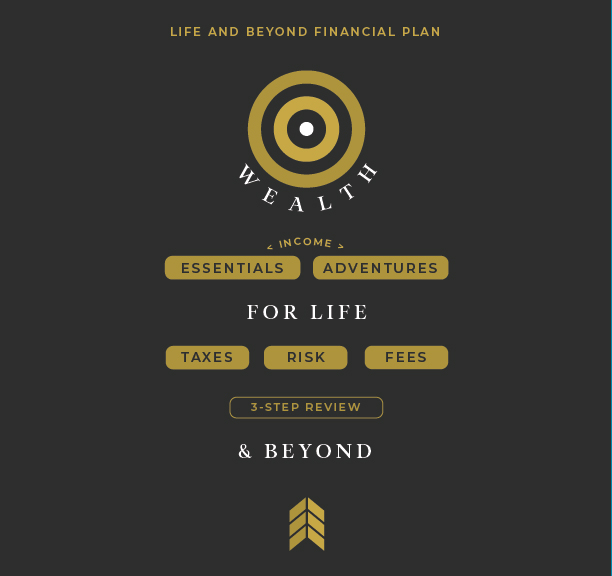

Just as there is a key combination of factors in archery that guide an arrow to its intended target, there is also a key combination of factors that will help you to reach your retirement goals.

Leave nothing to chance

- You and the experts at Fletcher Financial Group are the archer, working together to create a comprehensive financial plan for your retirement.

- The exact amount of wealth you’ll need is the target, making sure to cover both the essentials and the adventures. (If you don’t know this number yet, don’t worry—most people don’t until they’ve met with us!)

- Your actual dollars are the arrow—the investments and assets that make up your net worth (and just like the arrow, they are constantly wobbling off the path you’ve set them on—except in the case of your money it’s taxes, risk, and fees pulling it off course).

- Your Life and Beyond Plan is the fletching, helping everything to stay on course and ensuring you hit the financial target you’ve set for your retirement.

The archer leaves nothing to chance, and neither will we. It’s time to work together to create your plan for accumulating, investing, and enjoying your wealth.

Schedule Your Free Life and Beyond Planning Session

Get Ken's Financial Roadmap Video Course Free

when you sign up to receive his blog updates via email.